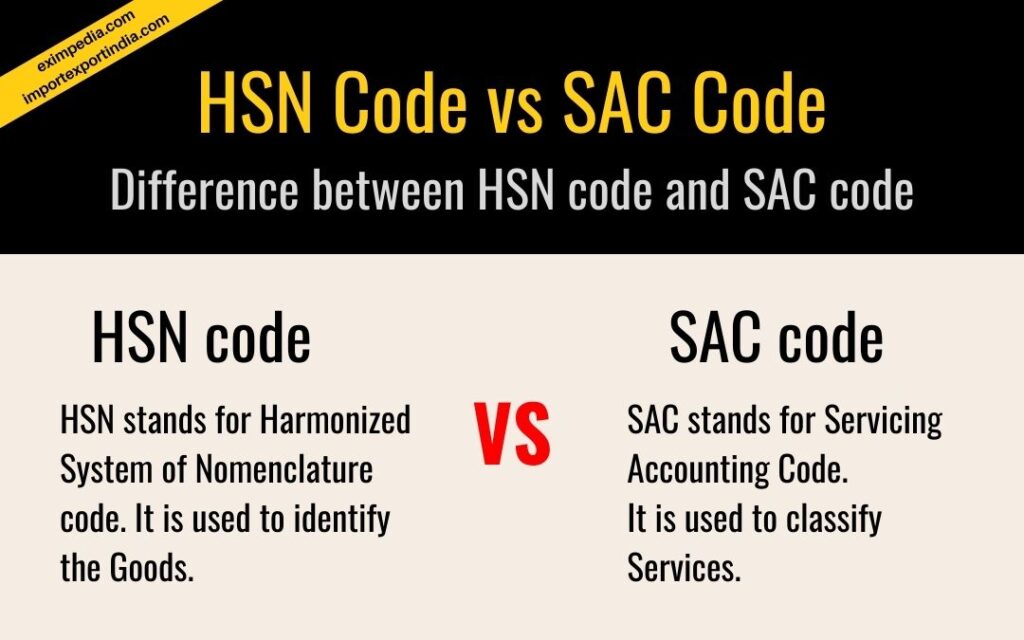

Know the Difference between HSN code and SAC code in GST in India. HSN code (HSN stands for Harmonised System of Nomenclature) is used to identify the Goods and SAC code (SAC stands for Servicing Accounting Code) is used to identify the services.

Table of Contents

Difference between HSN code and SAC code

If you are working in the field of import-export or associated with the logistics of foreign trade you should know that the HSN code and SAC code on trade invoices are mandatory from the 1st of April 2021 as per the revised requirements for GST taxpayers with a turnover of more than Rs.5 crores in the preceding financial year. Therefore it is very important to understand what is HSN and SAC code and the major difference between HSN code and SAC code.

To understand the difference between HSN code and SAC code let us first understand what is HAC code and what is SAC code.

What is HSN code?

HSN code is a short form of ‘Harmonised System of Nomenclature code. Initially, the World Customs Organization (WCO) has introduced the unique codification for all goods as a multipurpose international product nomenclature, with an idea to apply the classification of goods all over the World uniformly. The HSN codes are used worldwide. HSN codes were used in India from 1986 to classify the items/goods for Customs and Central Excise tariff duty. The same HSN codes of Customs tariff are used for the purpose of GST invoices.

The HSN codes started with 6 digits. However, subsequently, for more clarity, the Customs and Central Excise authorities added 2 more digits. Hence, presently 8 digit HSN codes are being used. The HSN code is predefined in a total of 8 digits. The first group of 2 digits indicates the chapter number of GST. The next 2 digits indicate the headings under that chapter. The next 2 digits indicate subheading and the last 2 digits indicate the further subheading.

We have mentioned the difference between HSN code and SAC code below in this article, please stay tuned with us.

The classification of goods is made in HSN code as under:

There is a total of 21 sections, 99 chapters, 1244 headings, and 5224 subheadings.

Conditions for applicability of HSN code

- For small taxpayers having annual turnover below Rs.1.5 crore in any preceding financial year, there is no need to mention HSN codes.

- For turnover between Rs.1.5 crore to Rs.5 crore, to use only first two digits of the HSN code.

- For turnover more than Rs.5 crore, to apply 6 digits of the HSN code and wherever necessary, to use 8 digits of the HSN code.

For more details, the Notification no. 78/2020 – Central Tax New Delhi, dated 15.10.2020 issued by the Government of India Ministry of Finance (Department of Revenue) Central Board of Indirect Taxes and Customs may be referred.

How to find HSN code

Let us see how to find an HSN code for our product. First, we have to select the appropriate Chapter, then select Section and then filter the subheading to finally get the product code. e.g. HSN code for Aerated water is 22021010.2202 where 22 is the Chapter, 02 is the Section, 10 is the subheading and 10 is a further subheading.

What is the SAC code

SAC is the short form of Services Accounting Code (SAC). This is a classification system for all services which is developed by the GST Department of India. With the help of the SAC code, the GST rates on services are fixed in five slabs of 0%, 5%, 12%, 18%, and 28%.

In India, tax on services is categorized roughly over 120 services for levy of GST under above mentioned 5 tax-slabs.

The SAC codes started with 6 digits. The first 2 digits (99) are common for all services. The next 2 digits indicate the major nature of service and the last 2 digits indicate the detailed nature of service.

Difference between HSN and SAC codes in GST

The main significant difference between HSN code and SAC code is that – The Harmonized System of Nomenclature (HSN) code is used for the classification of commodities/ goods under GST. These codes have been issued by World Customs Organization (WCO). Whereas, the Services Accounting Code (SAC) is used for the classification of services. These codes are issued by the Central Board of Excise and Customs (CBEC) department.

We hope that you must have understood all the information about HSN vs SAC and the major difference between HSN code and SAC code in detail. If you have any questions related to HSN and SAC then please comment down below, we will be glad to solve all your queries.

WWW.EXIMPEDIA.COM gives all the information related to import, export, and foreign trade. We at EXIMPEDIA help importers and exporters to start, grow and develop their business by sharing all the updates, news, tips, know-how, business ideas, documentation process, legal process, list of buyers & sellers, exhibition and event updates related to import and export business.