AD Code Registration Steps include 3 simple yet essential procedures discussed in this article with examples for a clear understanding of AD Code also known as Authorized Dealer Code and is considered one of the most important documents for export and import from India.

Authorized Dealer code (AD Code) is a unique 14-digit code necessary for exporters, importers, and trade documentation. It is issued by a bank to current A/c holders after successful registration of IEC through DGFT.

AD CODE – DETAILED GUIDE with FAQ’s

The most important documents needed for Export and Import are IEC, AD Code, Bill of Lading or Airway bill, and Shipping Bill or Bill of Entry. Here we will talk about AD Code which is the second most important document needed for export/import once you apply and have got your IEC.

We have made this article in a FAQ format for you so you can specifically search for the question you want your answer for, to make it short and precise. The main focus of this article is to help you with the AD code meaning in shipping and what are the AD Code registration steps.

What is the AD Code full form?

AD code full form is “Authorized Dealer Code”. AD code is obtained from the bank where you or your company holds a current account. This is generally used by exporters and importers or parties dealing in foreign currencies.

What is AD Code?

AD Code means Authorized Dealer Code. It is issued by the bank in which you or your company holds a current account. The bank must be authorized by RBI to deal in foreign exchange. AD code full form is ‘Authorized Dealer Code’ is mainly required to export or import goods in the country as without this Code it is not possible to generate a shipping bill or bill of entry for clearing goods from customs. Hence many people also actively search for AD code for import.

AD Code should be registered at every port separately for performing import/export activities. It helps the government to keep track of foreign currencies flowing in and out of the country. IEC (Import Export Code) & AD code are two of the most important documents for importing or exporting. After knowing the AD Code meaning in shipping, you must also know that the AD code registration steps are a very simple 3-step process from your end.

AD code is 7-digit or 14-digit? OR How many digits is the AD code?

AD code or Authorized dealer Code is a 7-digit or 14-digit code depending on the bank. Generally, in Export & Import 7-digit AD code is used with the 14-digit Account number of the bank in which you have a current account. It is very important to check that the bank is authorized by the Reserve Bank of India to deal in foreign currencies, or they won’t be able to issue AD codes to you. RBI gives the AD Code to the bank.

Is AD Code required for Import?

Yes, an AD code for import is required for the Import to file a Bill of Entry. The EDI (Electronic Data Interchange System) customs system enables us to file bills of entry on ICEGATE (Indian Customs Electronic Gateway) connected to banking systems. At the time of filing, an error will be shown if the AD code is not mentioned in the Bill of entry. Unlike Export, it is not mandatory to register the AD Code for Imports on ICEGATE for filing the bill of entry.

Can we get the AD Code online?

No, unfortunately, you cannot get an AD Code online, but you can find it online on ICEGATE if you have forgotten it with the help of your IEC. To get the new AD Code you must physically visit your bank where you hold a current account and are planning to deal in foreign exchange. Your bank must be authorized to deal in foreign exchange for issuing in AD Code. You can follow the AD Code registration steps given in the next question to get an AD code or you can simply ask your bank about their procedures to obtain an AD Code.

How to get AD Code? How to apply for an AD Code number?

Please follow the below steps for AD code and IFSC code registration –

1). AD Code registration steps are just 3 simple steps that you need to know –

2). You must first open a current account in a bank authorized by RBI to deal in foreign exchange.

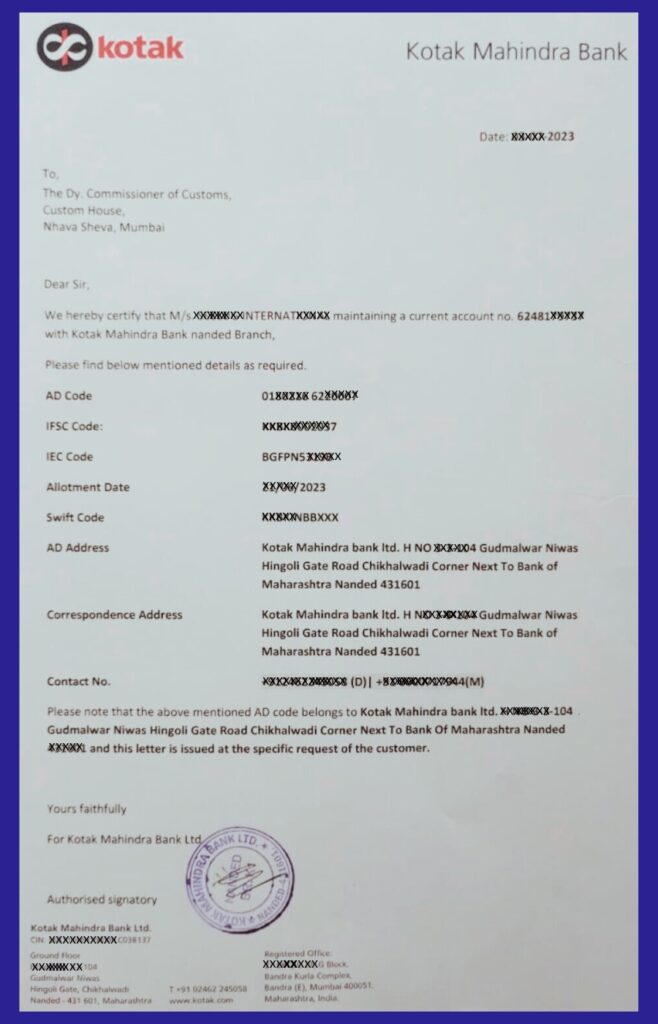

3). Once you have a current account, write a letter to the bank manager in which you hold a current account in a format prescribed by DGFT – AD Code letter to the bank

4). Then, the bank will issue you a letter on their letterhead with the AD Code for the port you are importing/exporting in or from.

AD Code registration Steps in customs?

For Exports, it is mandatory to register the AD Code for export on ICEGATE or you won’t be able to file the shipping bill. Hence you must know the process of AD code registration on ICEGATE

AD Code registration steps are done in customs in 2 ways, online and offline –

AD Code registration on ICEGATE

- Before starting the process of AD code registration on Icegate, please keep all the required documents ready and digitally sign them with the help of DSC. The documents you need are a Bank letter, Company PAN, Updated IEC, Aadhar card of authorized signatory same as mentioned on the IEC, GST copy, and canceled cheque.

- Register or Login on ICEGATE website – OLD website

- Once you are logged in click on E-sanchit on the left-hand side then click on “filing services”

- Click on upload documents and upload all digitally signed documents here. Then click on submit. Take note of IRN & DRN numbers/

- Then, on the left-hand side click on “Financial services”, then Click on “Bank Account Management” in the drop-down list.

- Then select “Authorised Dealer Code registration” and click “submit” which will take you to the registration page. Then click on “Add New Account”

- Fill in your details like bank account number, bank name, AD Code, IRN/DRn number you obtained, port Code in Location Code, and your ICEGATE ID.

- You will then receive an OTP on the email or mobile number you have registered on ICEGATE. Fill in and verify the same in the blank given.

- You can now see the status of your registration on the next screen.

And you are done! The approval for your AD Code registration on Icegate will take a few days to reflect for which you will receive the updates on your registered email.

We would suggest asking your Custom House Agent for their AD code registration services or you must check with your bank where you maintain your current account for your import, export, and foreign trade business.

AD code registration fee in India is from Rs. 1,000 to Rs. 2,999. This is a one-time fee to obtain a unique AD code.

AD Code registration steps in customs offline –

- You must first look for a customs house agent to help you with customs registration.

- Arrange for the below list of documents –

- GST registration of your company

- Your company PAN

- Board Resolution

- Income tax return of the company or yourself for the last 3 years

- Your bank statement for a month

- IEC (Import – Export Code), make sure it is updated. Know how to update your IEC.

- Export House Certificate (only if available)

- Cancelled cheque of bank with current account

- AD Code letter is given by your bank.

- Letter from the bank stating you hold a current account.

Registering an AD code usually takes 3 to 4 working days. So plan your shipments accordingly and get the documents ready well in advance. Your CHA will help you make the registration process faster in exchange for some fee.

Is the AD code different for different banks?

Yes, the AD code and IFSC code registration process is different for different banks as the Reserve Bank of India gives unique codes to each bank. So, if you are planning to import on the same port but by using different bank accounts then you will have to register both bank accounts on the same port.

The AD Code meaning in shipping is the same for all ports but you will have to register it separately on each customs port.

Who can register AD Code?

Registration of AD Code can be done by all importers or exporters holding a current account in foreign exchange-authorized banks, it can be done online via the ICEGATE portal or offline with the help of a custom broker. Your bank will give you an AD Code.

What is the Validity of an AD Code?

AD Code validity is for a lifetime till your bank account and bank exist. There is no need for renewal as such.

Can we Change the AD Code?

Yes, but you will have to submit a letter from the bank for any such change in the AD code and also the reason why you want to change it. AD Code is changed rarely as RBI gives the code to the banks. But, if you have switched the bank altogether, then you will have to do the entire registration process again to register/change to this new AD code.

What is the new Rule of the AD Code?

The new rule of AD Code is that the AD code should be registered separately on each port so it is easier to find the code on any port at any given point in time. It is compulsory to register the AD code on the port you are planning to export from.

Is AD code compulsory for Import and Export?

Yes, AD Code is compulsory for import and export as without it the bill of entry or shipping bill cannot be filed. It is not compulsory to register the AD code on the customs ICEGATE portal for import shipments but it is compulsory to register for the AD code for export shipments.

Is the AD Code for export and import the same?

Yes, the AD Code for export and the AD code for Import is the same if you use the same bank account for import and export transactions. Your bank will give you only one AD code which you have to register in customs. AD Code for export is obtained from the bank which must be registered on the customs ICEGATE portal while it is not mandatory to do so for imports.

So, this is all you need to know about AD Code. So, if you are planning to Export or Import, AD Code is most important to consider as

You can look for detailed articles on –

Of course, if you have any questions, you can write them down in the comment section below and the Eximpedia team will be happy to help.